|

| by Alex Hermann Research Assistant |

The increases

in home prices that have occurred since the Great Recession not only vary across

the nation’s metropolitan areas, they also vary within many metros as well. The

San Francisco metropolitan area, where home values are now 16 percent above

their pre-recession peak, and the St. Louis metropolitan area, where home values

are still 10 percent below their pre-recession peak, illustrate these

variations.

In both areas,

median home prices in low-income ZIP Codes are less likely to exceed mid-2000

peaks than median prices in high- and moderate-income ZIPs. However, the

regions vary when looking at the changes in house prices between 2000 and 2016.

Over that time period, the percentage increase in median prices in the Bay Area’s

low-income ZIPs was greater than the increases in high- and moderate-income

ones. In contrast, the percentage increase in St. Louis’ low-income ZIP Codes

was much smaller than the increase in that region’s high- and moderate-income ZIP

Codes. (In this analysis, low-, moderate-, and high-income ZIP Codes have a

median household income under 80 percent, between 80 and 120 percent, and above

120 percent of their state’s median income, respectively.)

Changes in

home price also vary within both metros. For example, metropolitan San Francisco has had the eighth strongest post-recession

recovery in home prices. As a result, median home values in San Francisco’s

high-income ZIP Codes are about $1.18 million dollars while the median value in

low-income ones are $586,000, more than three times the median price for the

U.S. as a whole, which is $186,500.

However, home

values in many of the region’s ZIP Codes are still below their pre-recession peak

(Figure 1). In all, 31 of San

Francisco’s 142 ZIPs, or 22 percent, have yet to regain their mid-2000 peaks,

including:

- 50 percent (5 of 10) of low-income ZIPs

- 35 percent (12 of 34) of moderate-income ZIPs, and

- 14 percent (14 of 98) of high-income ZIPs.

Source: JCHS tabulations of Zillow Home Value Index data and ACS 2014 5-year data

Most ZIP Codes

that have not regained their peak median home values are located on the

outskirts of Metro San Francisco, particularly in northern Contra Costa County.

That area is home to 10 of the 14 high-income ZIP Codes where median prices

have not exceeded their pre-recession peak as well as 8 of the 12

moderate-income ones and three of the five low-income ones. Most of the remaining ZIP Codes where prices

are still below pre-recession peaks are in the urban areas south of Oakland

along the East Bay, which includes many low and moderate-income ZIP Codes as

well as two high-income ones.

JCHS tabulations of Zillow Home Value Index data and ACS 2014 5-year data

The story is

somewhat different in metropolitan areas that have not seen San Francisco’s

rapid price appreciation, such as St. Louis, where home values in June 2016

were still 10 percent below their pre-recession peak. There, median prices exceeded their peaks in

only 27 of 147 ZIP Codes, most of them located in the region’s urban core and

suburban Madison County. (Figure 3). These unrecovered areas

include:

- 1 of 35 (3 percent) low-income ZIPs

- 6 of 55 (11 percent) moderate-income ZIPs, and

- 20 of 57 (35 percent) high-income ZIPs.

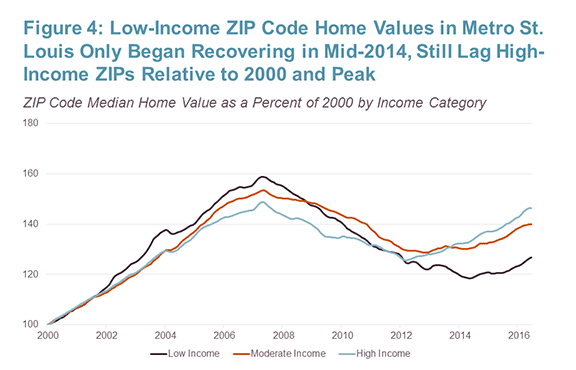

Moreover, unlike San Francisco, prices in low-income ZIP Codes in St. Louis have grown only modestly since 2000 and have increased much less than those in high- and moderate-income ZIP Codes. In the run-up to peak, prices in low-income ZIP Codes grew only marginally faster than prices in high-income ZIPs. Additionally, the post-recession upturn in home values in low-income ZIPs lagged the increase in high-income ZIP Codes by nearly two years (Figure 4).

JCHS tabulations of Zillow Home Value Index data and ACS 2014 5-year data

What to take

away from this analysis? Overall, home values in high-income ZIP Codes have

outpaced home-value gains in low-income ZIPs since the price peak of the

mid-2000s. When taking a broader view, low-income ZIP Codes have performed as

well as high-income ZIPs since 2000 in fast-appreciating markets like San

Francisco, while in many lagging markets, like St. Louis, home value gains in

high-income ZIPs have typically surpassed those in low-income ZIPs. Furthermore,

though income levels are important they are not determinative. The geographic

patterns also underscore the fact that trends in home values are also a

function of features such as density and proximity to the central city.

These relationships, and others, will be discussed in a forthcoming Joint Center working paper on home value trends since 2000.

These relationships, and others, will be discussed in a forthcoming Joint Center working paper on home value trends since 2000.

No comments:

Post a Comment